Can Cryptocurrency replace Conventional Money in the future? - Muhammad Sheharyar Ullah Khan

- thevisionairemagaz

- Oct 30, 2023

- 10 min read

Updated: Feb 7, 2024

Author: Muhammad Sheharyar Ullah Khan

Reviewed and Published by:

The Visionaire Research by The Visionaire Magazine

TABLE OF CONTENTS

Aim and Method of Research

Introduction

Storing Cryptocurrency

The Good

The Bad

The Ugly

Public Consensus

Conclusion

Citations & References

AIM OF RESEARCH AND HYPOTHESIS

The aim of this research is to understand the effect of cryptocurrency on the global economy and point out the reasons behind the recent boom in crypto trading whilst uncovering the susceptibility and security of high end crypto trading on international levels. The research was also conducted to reach a conclusion on whether cryptocurrency has the potential to replace fiat currency as the main mode of currency exchange in near future. On the other hand, the research also aimed to weigh the role and effects of the crypto market in the recent crash in stock market during and after Covid-19. The hypothesis is that cryptocurrency can be very useful as a quicker mode of money exchange and a monumental step towards digitalization but misuse can lead to catastrophe.

Method of Research

I have used data spanning from over 20 years and compared each year’s statistical data to see the general trend of the crypto market. Instead of just relying on statistical data from trusted resources, I did a survey to get to know the personal opinion of people over the years and compiled that information in forms of pie charts, bar graphs and cumulative frequency curves. Apart from that, different types of cryptocurrencies were compared to see how each type has been performing over the years.

INTRODUCTION

Cryptocurrency is an online digital payment system that does not rely on banks to verify transactions. Cryptocurrency payments exist purely as digital entries into an online database. When cryptocurrency funds are transferred, the transfers are recorded in a public ledger. In crypto, the medium of exchange are called “coins” which are generated or produced by “miners” who are people who run programs on ASIC(Application Specific Integrated Circuit). The work behind mining coins gives them value, while the scarcity of coins and primarily the demand for them causes their values to fluctuate. Crypto can be used to buy goods digitally just like fiat currency and uses high end encryption to protect and verify transactions.

HOW TO BUY CRYPTOCURRENCY?

There are two steps involved in buying cryptocurrency as follows:

1) Choosing a Platform: There are two platforms that we can buy from. The first one being TRADITIONAL BROKERS who offer to buy and sell cryptocurrencies along with stocks, bonds etc. They offer lower trading costs but at the expense of security and lack some crypto trading features. On the other hand we have CRYPTO EXCHANGES which are licensed companies with higher service charges but better encryption and a variety of cryptocurrencies and wallets to choose from. Crypto exchanges can further be classified into 2 types: Centralized and Decentralized Exchanges. Centralized exchanges are operated by one central authority that manages a network of transactions. The company in charge is responsible for holding a ledger, executing transactions, securing user data, and the other responsibilities that come with managing a financial system, While Decentralized exchanges are the animals of the blockchain and don't rely on any third party source e.g. banks, companies or any centralized authorities but instead use an interwoven system of users and their devices. By widely distributing the network, it gives each user an equal share in ownership and eliminates dependance on third parties. Figure 1.0 Summarises this concept in a comprehensible way.

2) Funding your account: After choosing the platform, the next step is to fund your account. Most crypto exchanges accept fiat currencies mainly US DOLLAR and EURO alongside credit and debit cards. An important factor to consider here is that each withdrawal or transaction fee includes a trading fee given to the exchange.

Figure 1.0

STORING CRYPTOCURRENCY

Once the cryptocurrency has been purchased, it needs to be stored from hackers. The usual place to store the currency are crypto wallets that can be physical devices or online softwares. These wallets can further be classified into 4 types. Table 1.1 summarizes this.

Table 1.1:

THE GOOD

Cryptocurrency has had a huge boom in the past decade due to several reasons. A survey of people in my city reveals the reasons behind their interest in crypto and how this interest has varied over the years. Chart 1.2 summarizes the aspects of crypto that attract them the most. Some of the most common answers are listed below:

Security and Privacy:

Cryptocurrencies use “cryptographic” techniques to ensure the security and integrity of transactions and to protect against hacking and fraud. On top of that, while most crypto exchanges are not completely anonymous, they do offer a high degree of privacy and allow users to transact without revealing their identity which, according to my survey, was the dominant reason for the inclination of the masses towards crypto trading.

Unstable Economic Conditions:

In the country of survey, economic conditions fluctuate every now and then and after covid, with the world food shortages, inflation has hit an all time high. In these times, crypto has provided the public with a secure form of investment in which they don't need to liquidate their funds and can also make a profit out of their investment.

Global Accessibility:

With the crypto market spanning over the entire globe, it has become an easy and efficient way to transfer funds and go on about daily life without the hassle of keeping liquid money. Moreover, it can be used anywhere and everywhere in the world; all that is required is a stable internet connection.

Blockchain Technology:

Blockchain is a decentralized and distributed digital ledger that records transactions on a peer-to-peer network. In simple terms, it is a digital database that stores data across a number of computers, with each block of data linked to the previous one, forming a chain. Blockchain ensures a secure and private network for transactions and gives anonymity to the people.

Control over wallet and no use of personal data:

This is an important point. Today, the majority of purchases are made with credit cards which are highly unreliable. Filling forms on websites, customers are asked to give card number, expiration date and code, which makes it a very insecure method of payment. Therefore many credit cards are stolen. Crypto doesn't require any disclosure of personal information. Instead, it has two keys: private and public. The public key is available to all(i.e the address of the crypto wallet) while the private key is only known to the owner. Hence, in this way, integrity of information is maintained during every transaction. No one apart from the owner can withdraw coins from the wallet which can only be accessed by the private key.

Variety of Cryptocurrencies:

With the increasing popularity of cryptocurrency, many different parties have entered the scene to get a share of this lucrative business. The most prominent and widely used cryptocurrency is Bitcoin. Other players launched different coins using the same Blockchain Technology. The most noteworthy Bitcoin alternative is Ethereum, which has the second largest market cap in the crypto industry. The following list shows currencies with the largest market capitalizations available for trade on popular exchange, Coinbase, as of May 31, 2022. All the notable currencies have been summarized in the Bar Graph 1.3:

Bitcoin

Ethereum

Ethereum 2

Binance USD

Tether

USD coin

BNB

Cardano

XRP

Solana

Graph 1.2( Bitcoin vs Ethereum: Market Titans)

Chart 1.3( Public Survey: Primary Reasons for Crypto Boom)

Bar Graph 1.4 (Notable Exchanges)

THE BAD

As I delved deeper into this realm of digital revolution, more loopholes emerged which are being exploited by people and it is quite obvious that Crypto Market is held by a single thread- the moment this thread snaps, the whole industry will plunge into unprecedented disaster and the global economy will see an unlike any other recession. The following are the reasons which highlight the darker side of crypto:

No legislation regarding crypto:

After going through hundreds of articles and by the consensus of the public, the main drawback of crypto is the fact that it is not legalized by most governments in the world. What this basically means is that crypto is an industry not backed by the government hence if any loss or scam happens, government agencies are not responsible to pursue your case and in most cases, you lose your money. Therefore the risk factor is always present and due to fluctuating government policies regarding crypto, there is a high volatility in Bitcoin(BTC) and other coin prices. To add to that, as the government has no such control over crypto trading, now crypto is being used in innumerable illegal and terrorist activities, money laundering and due to a lack of central issues, there is no legal formal entity to guarantee in case of bankruptcy. For example, the dark web marketplaces have been taking advantage of the fact that crypto provides anonymity and have been dealing in trades using Bitcoin, Monero and Ethereum. Dark web marketplaces like AlphaBay and SilkRoad took authorities years to take down just because of the fact that all transactions were made using BTC.

Influencer Marketing:

The hype of cryptocurrency is also being misused by public figures and as majority of people trading in the crypto have insufficient knowledge about this market, they are easily influenced by Influencer Marketing. The most obvious case of such a strategy, according to my research, is Elon Musk and his ways of earning millions through BTC. Elon’s company Tesla invested $1.5 million into BTC and started accepting payments in Bitcoin. He started promoting BTC on his 56.8 million followers Twitter account which caused the prices of Bitcoin to soar and this way the company made millions in profit. Elon has such a control over the crypto market that once when he tweeted about no longer accepting BTC payments for Tesla due to unsustainable methods of BTC, Bitcoin saw a more than 30% decline in its value with investors losing around $150 billion dollars. On May 17,2021 The Wall Street Journal published an article with the heading, “Elon Musk tweet prompts Bitcoin Selloff”. Graph 1.5 shows the “Musk Effect '', as I call it.

Graph 1.5 ( Elon’s Effect on BTC)

(Source: Wall Street Journal)

THE UGLY

Sam Bankman Fried and the FTX Saga

Cryptocurrency is obviously susceptible to scams and hacked accounts but what if a multi-billion dollar company who takes your money in exchange for crypto coins comes out to be fraudulent? Well unfortunately this is the case of FTX and Alameda Research.

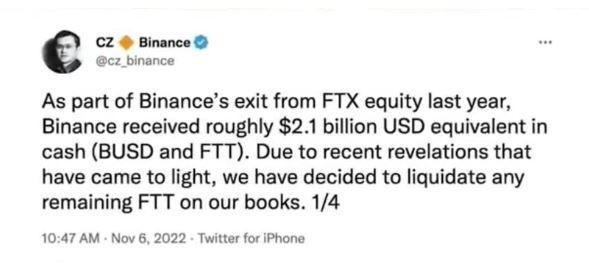

Sam Bankman Fried, a MIT graduate, joined Jane Street( a trading firm) in 2014. Working there, Sam discovers a loophole in the cryptomarket and starts exploiting it by buying cryptocurrency in the USA and selling it in the Japanese crypto market on profit. This was such a lucrative business in which Sam sometimes made over $25 million off of just crypto trading. With the profits, he went on to build his own crypto trading firm by the name of “Alameda Research” with his friends and ex-colleagues. Alameda research used to take money from investors and invest that money into cryptocurrency with a guaranteed yearly profit of 15%. Overtime, Alameda Research grew to become a trusted crypto trading firm and with billions of dollars invested in it by the masses over the world. However, the main issue which I found during my research was that the people heading Alameda Research had NO prior experience of the field and were fresh graduates playing with life savings of people. However, Sam wanted to grow regardless and in 2019, he opened his own crypto exchange by the name of FTX and introduced his own currency by the name of FTT coins. So now profits for Sam doubled as the trading exchange fee which they had to pay before was 0 because now they were trading on their own company. The trust developed from Alameda Research brought a huge customer inflow to FTX but the FTT coin still had no value in front of the likes of Bitcoin and Ethereum. Sam, in his pursuit to promote FTT, started giving customers who used FTT for trading a hefty discount on trading fees. Naturally, people investors started buying FTT in bulk and this strategy worked out for Sam as he made billions as FTT soared to $80/coin. This is where the fairytale takes a turn for the worst. Sam started investing customer funds into other industries with the hope of making a profit and returning the funds back to the FTX exchange where people thought their money would be. So basically Sam was illegally using people’s money which they had invested into FTX without their consent and risking it all just to make some profit. On the front end, everyone thought their money was safe in their FTX accounts and could withdraw whenever they wanted, but in reality, there was no money present in their accounts. With the Covid-19 hit in 2020, inflation hit everyone and so people started withdrawing their crypto funds: only to realize that there was no money present. To add insult to injury, Caroline Ellison, CEO of Alameda Research and a close friend of Sam spilled the beans in an interview with the Wall Street Journal where she said, “ FTX used customer money to help Alameda meet its liabilities”. This spelt disaster as everyone started withdrawing their investment in FTX but Sam had no money left to give. Sam had used $10 Billion of people and FTX only had $900 million in its reserves which meant Sam had used over 90% of hard earned money. To put the nail in the coffin, Chanpeng Zhao, CEO of Binance, announced that he would be liquidating all $500 million of FTT tokens he had due to the fraud FTX was doing. On November 11, 2022 FTX alongside Alameda Research declared bankruptcy under Chapter 11 of international law. The people who had invested into these companies could no longer redeem the money they had lost to the insolence of Sam and co. After the FTX disaster, the crypto market has never remained the same as the trust factor on these trading companies has been eradicated due to the fraud of Alameda Research and FTX. Figure 2.0 and 2.1 show the tweets which plummeted FTX.

Figure 2.0( Binance withdrawing all support to FTX)

Figure 2.1( Binance liquidating all its investment from FTX)

Public Consensus

I went on to ask the general public to bring some personal preferences in the research rather than basing my conclusion on statistical data only. The method of survey was that I went to different people belonging to different demographics and also people related to the crypto field itself. A total of 500 people were asked their opinion on cryptocurrency. The bar graph 2.2 represents public opinion on crypto according to my research.

Bar Graph 2.2( Public Survey by Age Group)

Conclusion

After this research, two things are very evident. One that cryptocurrency is a topic that is looked at with skepticism and optimism. Different age demographics have different opinions with the fresher blood more allured to the prospects of crypto while the experienced and seasoned people are less inclined to crypto trading primarily due to the high risk factor and lack of proper legal structure. That being said, my research found that the future of cryptocurrency can be very bright if some institutional-formal conditions are met. The use of crypto in facilitation of trade, reduced costs and faster transactions are recognized by every professional. Bitcoin and other cryptocurrency have the potential to replace traditional and new payment methods if steps are taken in the right direction. To become a dominant power in the global system of payments, crypto firms must provide distinctive incremental value, to address and overcome a number of critical challenges, such as the formal regulatory issues. That is obviously unlikely to happen in the short term but if these changes are made progressively, I am sure crypto is truly a sustainable alternative to the conventional mode of payment system which includes fiat currency, Paypal etc. In the meantime, banks and financial institutions should take a closer look at the Blockchain Technology underlying the crypto market as a new way to ensure security and integrity of data.

Citations and References

Written by:

Muhammad Sheharyar Ullah Khan

Reviewed and Published by: The Visionaire Research by The Visionaire Magazine thevisionairemagazine@gmail.com

Comments